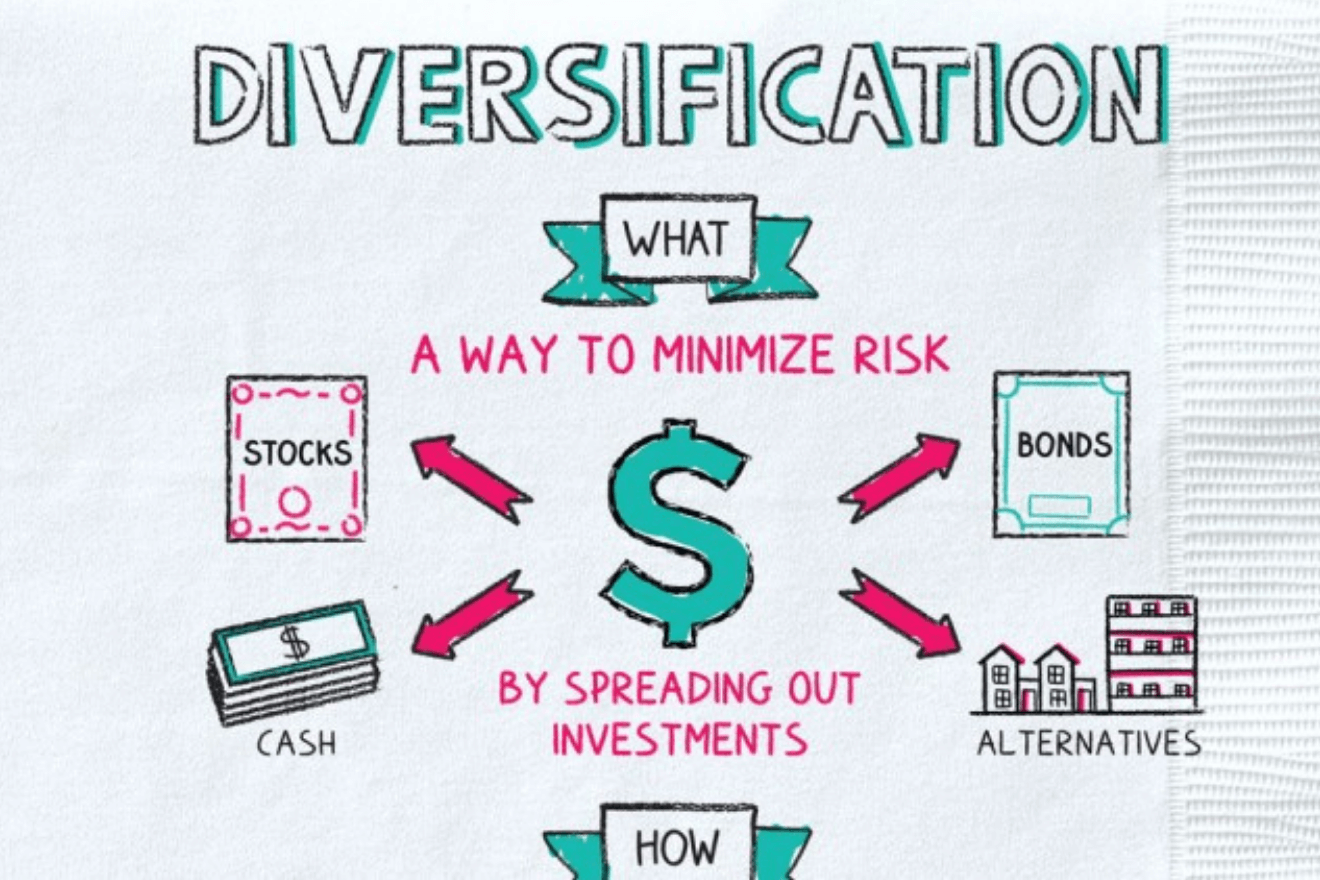

In today’s financial marketplace, every investor is applying various strategies to reduce risk. One such effective technique that minimizes the risk is diversification. It reduces the volatility of your portfolio by allocating investments among various, industries, financial instruments, and other such categories. Almost every investment professional agree that diversification is the essential strategy of reaching the long-term financial goal while reducing risk.

Diversification focuses on maximizing the return by investing in various areas that would react differently to the same situation. It does not guarantee against loss, but it reduce the chance of risk to some extent. You will need to diversify if you want to protect yourself from the market downturn. Let’s take a look at some benefits of diversification.

1. Reduction of Risk

Diversification cannot eliminate the risk completely, but it can manage the risk level to some extent. Risk accompanied every investment, but its probability can be minimized. Most of the young investors have less risk tolerance, so they have to use diversification. Too much risk can annihilate retirement plans, so people cannot bear greater risks. In order to beat this economic downturn, every investor diversifies amongst their asset classes but they failed to apply it properly, and they get exposed to the stock market risk. Diversification can maximize returns and reduce their investment portfolio risk.

Generally, the market risks affect almost every stock, so you will have to diversify among various asset classes. The basic rule of thumb is to find a medium point between return and the risk. Diversification will ensure that you can achieve your financial aims while still sleeping calmly at night.

2. Protection of the Investor’s Capital

Some of the investors use capital preservation as an investment strategy for protecting their capital. This technique focuses on protecting the capital and ignore the rate of return on various investments. Diversification not only reduces the risk but also protects the capital of an investor by allocating money to various investment categories.

You do not need to worry about various companies that can ruin your retirement portfolio if you are diversifying your investment. Diversification can help in both capital preservation and investment risk management.

3. Hedge your Portfolio

You can grow your portfolio according to the market demands through diversification. It is observed that investors with 100% equity portfolio have very poor returns such past seven years. Their portfolios would have got greater returns if they had diversified their portfolios to include investing in bonds, metals, and commodities. An investor can get a chance of positive in one market through diversification when the other marketing is employing negative returns.

4. Make Partial Investments

It enables investors to make partial investments in the various asset classes. Investors usually avoid it as they feel uncomfortable committing 100 percent of their savings. Most of the retirees seek to minimize the risk in their portfolios. Retirees can reduce the risk by retaining at least a good percentage of their assets in the stock market. They increase their returns and make their portfolio free of risk. Related ItemsFeatured

David Aaron is a business author and expert who has written extensively on topics related to management, leadership, and organizational behavior. He is known for his practical insights and innovative approaches to solving business problems.